Manvest Inc.

With the Outfit’s strong history of operating businesses, Manvest Inc. (MVT) bring an operating mind-set to support entrepreneurs and businesses to grow and add value.

Manvest Inc.

Since 1978, the entrepreneurial spirit – ours and yours – has been at the heart of every private investment we make. Although our investment mandate has evolved with time, our focus on building great businesses remains at the core of what we do.

At Manvest, we invest in management teams. As operators, we respect the hard work and complex decisions that go into operating a business, and we want to help fuel your growth with business connectivity, a strategic sounding board and good governance practices.

We can also help with matters that can be distracting to management teams – such as capital raises and debt structure. Above everything else, we strive to be a good long-term partner.

The Manvest Advantage

We focus on strategic private equity and venture capital opportunities that foster innovation, growth and diversification. We have a broad investment reach focused on strong executional leadership.

- Patient capital with a long term-view

- Extensive operating experience

- Ability and enthusiasm to align and partner with investee companies

- Ability to access a large contact network

- Strong reputation

- Talent and resources to support growth in investee companies

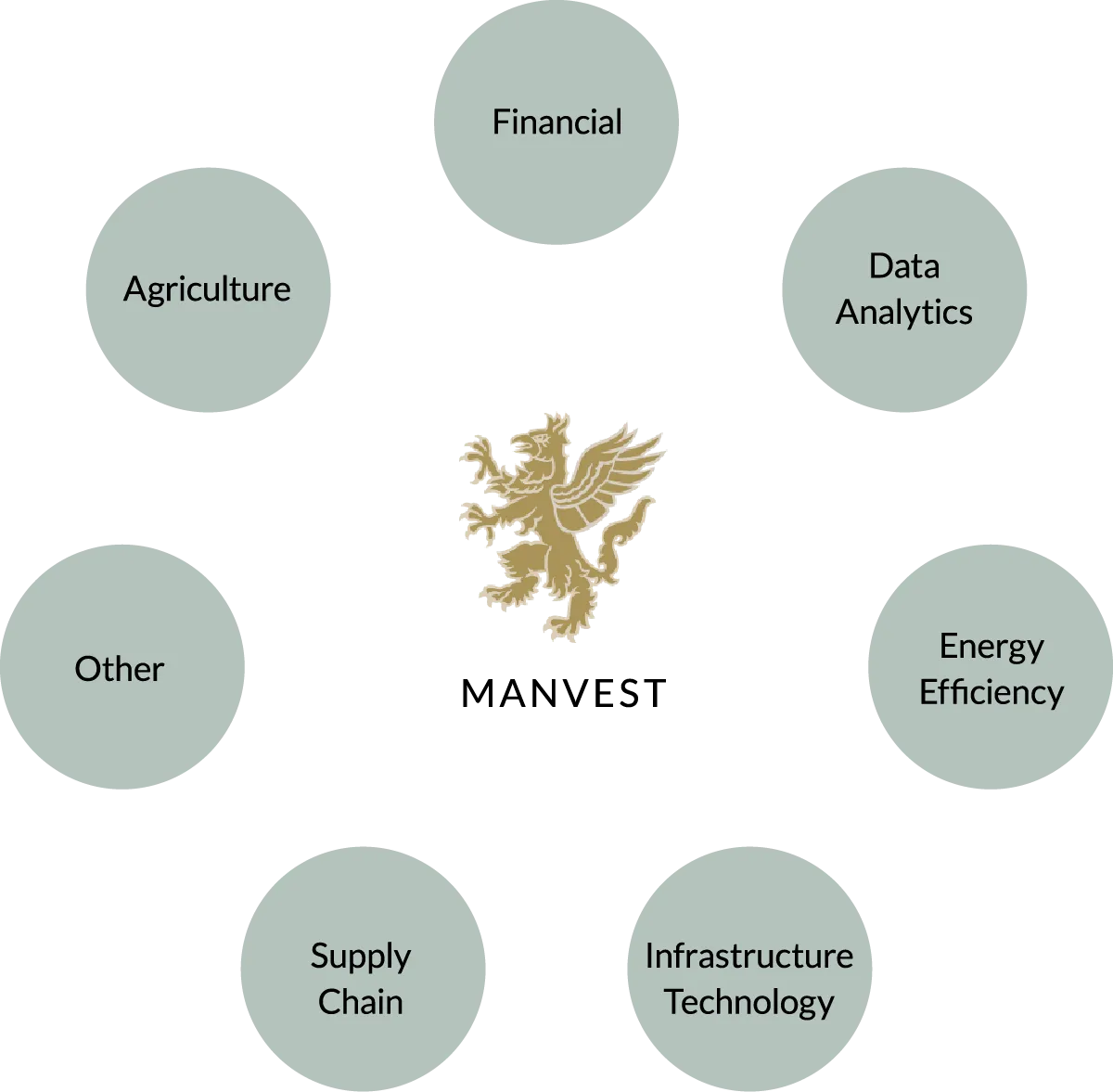

From AgTech, CleanTech and FinTech to Data Analytics and Infrastructure, we create value for stakeholders, and achieve solid returns with direct exposure to new industries, verticals and geographies.

Operating as the Group’s private capital investment team, we have the ability to review a wide range of opportunities with the ultimate goal of partnering with great management teams in high-growth, enduring markets.

We’re generational investors: we’re thinking right now about the spaces where the next generation of our company wants to be engaged 25 years from now.

We’re drawn to companies that are solving old problems in new ways, or that are solving the challenges of our collective future. Specifically, we’re seeking businesses that develop solutions and opportunities across these Investment Themes

Investing in venture capital can be risky business. But calculated risk is what Manvest Inc. thrives on. “People are everything. In this business it is extremely important to be a good judge of people. You not only have to have confidence in their abilities, you have to know you can work with them.”

“When the crowd runs toward gold, tread carefully; when they flee, start digging.”

– Ralph Lee

Select Portfolio Companies

Manvest Inc. is uniquely positioned as both an investor and partner.

Manvest invests in forward-thinking companies that are shaping the future of their industries. Our portfolio demonstrates a strong commitment to long-term value creation through strategic investments in sectors that promote sustainable growth and operational resilience. Select investments include:

Aureus

Energy Efficiency

Aureus is an ESG focused water management company using sustainable and disruptive technologies, providing innovative solutions and delivering superior execution. The company’s innovative and technical solutions throughout the life cycle of water management are designed to lower emissions, conserve water and create cost saving for clients in the energy sector.

Investment date: 2020

Blink Health

Supply Chain

US-based Blink Health is the leading technology platform and first online marketplace for prescription medicines. The company is driven to provide patients with the lowest price for prescription medicines through a focus on reinventing the supply chain.

Investment date: 2020

Fillip Fleet

Financial

Calgary-based digital fleet card platform to provide fleets, fleet management companies and fuel retailers with digital fuel cards, accessing the benefits and convenience of a platform for fleet cards and expense payment through an easy-to-use smartphone app.

Investment date: 2022

Nautilus Data Technologies

Data Analytics / Infrastructure Technology

US-based Nautilus Data Technologies is the leading pioneer in water-cooled data center infrastructure technology for high-performance, high-density, ultra-efficient and sustainable computing. Positioned at the center of growth in Artificial Intelligence the company’s technology provides not only the ability to cool the next generation of AI computing but significantly reduces the energy required.

Investment date: 2020

Sulvaris

Agriculture

Sulvaris is transforming nutrient efficiency in the agriculture industry by creating new sustainable products. By improving quality with proven results, Sulvaris provides a solution to significant growth in demand for fertilizers with limited natural resources. Sulvaris’ innovative and proprietary technologies create global solutions while solving environmental challenges from a variety of industries.

Investment date: 2013

Select Past Investments

Machine Learning eCommerce

Investment in a leading provider of relevancy-focused B2B eCommerce solutions, solving some of eCommerce’s largest challenges around site search, product recommendations, personalization, SEO, SEM and scale – helping leading retailers and brands to create a fundamentally better user experience with proven business results.

Exited

A Deliotte Fast 50 fastest growing technology company in 2016, Manvest provided growth capital to a proven management team. The company led the way in Machine Learning in the Fintech space, winning in B2B eCommerce. Manvest exited during a financing round with a US based private equity firm.

Veterinary Roll-up

Investment in an early consolidator of veterinary practices, the company aggregated individual practices into a network of veterinary practices providing superior care services.

Exited

Manvest exited as part of a sale to a US based strategic operator.

Sporting Goods

Investment in a start-up sporting goods manufacturer, distributor and marketer. The company exploited unique proprietary technology and an execution plan to partner with North American independent retailers.

Exited

The company grew to be the premier high-end brand in the space leading to a marketed exit to a Canadian Private Equity firm.

Partnerships

Manvest is proud to partner with forward-thinking organizations.

Strategic partnerships strengthen our ability to support innovative, high-potential ventures and reinforce our commitment to driving growth, diversification and long-term value.